The First Time Home Buyer

In a changing market, it is important to understand the needs of all prospective buyers. With house prices “correcting” or “falling” across much of Australia, it is becoming increasingly possible for first time buyers to make their first purchase. So how many properties in Australia are actually purchased by a first time buyer?

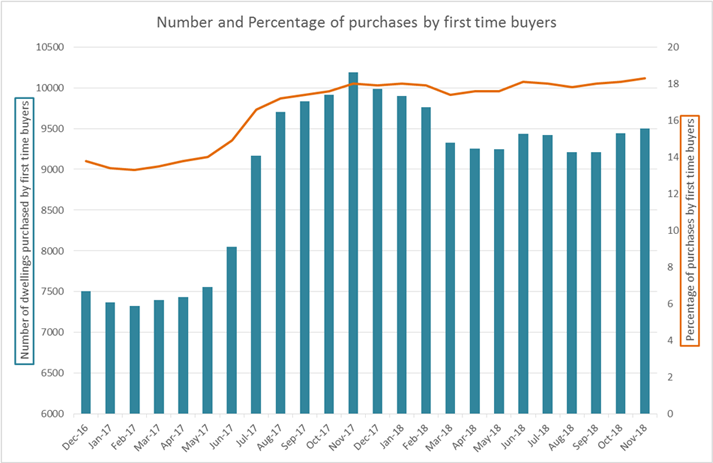

Using data from the Australian Bureau of Statistics(Housing Finance monthly reports), we can see that the number of purchases per month made by the first time buyer has increased across the June 2017 to November 2017 period (from approximately 8,000 to 10,000 purchases) (see graph below). This increase in total purchases corresponds to an increase in the proportion of total dwellings purchased by first time buyers from approximately 14% to 18%. First time buyers are increasingly becoming a market that we need to understand.

One question that first time buyers may have when they start their journey to home ownership is what grants and concessions may be available to them. Being familiar with this changing, state based grants are particularly important when listing properties that have a guide price close to the grant and/or concession value cut-offs. The table below details the currently available (as of 20 April 2019) first home owner grants available in each state and territory. The link provided details further eligibility criteria and other related information which may provide useful in understanding the first time buyer.

| State/territory | Details of first home owner grants (FHOG) for eligible applicants | Further info available |

| ACT |

|

Click here |

| NSW |

|

Click here |

| NT |

|

Click here |

| QLD |

|

Click here |

| SA |

|

Click here |

| TAS |

|

Click here |

| VIC |

|

Click here |

| WA |

|

Click here |