Let’s set the scene.

You are currently working in Real Estate.

You’re either a principle or employed as an agent.

You may or may not love your job (like the rest of us), but you’re earning a reasonable salary, have most of the things you need and want, and you are breezing through life fairly comfortably right now.

So, have you considered your future? Do you have an active plan for your retirement? Have you considered how much you will need?

If the answer is to all these questions is no, you’re not alone.

In a study on retirement readiness across the USA, the UK and Australia, conducted by the Actuaries Institute Australia it was found that the majority of people are not preparing adequately to retire. Perhaps of greatest concern is that those aged between 35 and 54 are the least prepared.

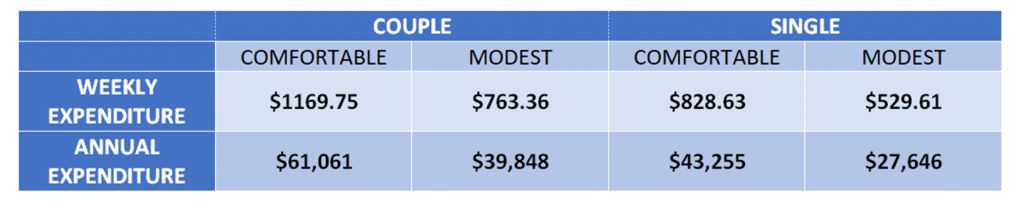

If you are unsure of how much you will need to retire, The Association of Superannuation Funds of Australia (ASFA) has estimated the yearly income a retiree would need to retire “comfortably” or “modestly”, based on a retiree who owns their own home and is between 65 and 85 is as follows:

We would like to highlight some of the key benefits that you should be aware of.So whether you’re young or old, working or retired or employed or between jobs – it’s always the right time to be thinking about superannuation. For most people, superannuation savings will be one of their most significant assets when they retire. The importance of understanding the system and appropriate planning cannot be underestimated.

Let’s get started:

- Concessional super contributions

Concessional super contributions are contributions made before tax.

These contributions include:

- compulsory contributions made by your employer,

- salary sacrificed contributions and

- contributions made from your personal bank account when you elect to claim a tax deduction.

Concessional super contributions are taxed in your superannuation fund at 15%. This may seem like a lot given that you’re providing for your own retirement but it’s a lot less than the tax imposed on your other income outside of super.

These taxes can range from 0% to 47% depending on how much you earn! For example, If you earn employment income of $80,000, you will be paying 34.5% tax in every dollar that you earn over $37,000. $5,000 concessional super contribution as an example will save you $975 in tax.

You should be aware that concessional super contributions are capped and if you contribute more than $25,000 per annum you will be subject to extra tax.

- Super co-contribution

Read carefully… the Government is giving out money (conditions apply)!

The super co-contribution is a $500 contribution that the Government will make to super on your behalf if you contribute $1,000 from your after tax money as a non concessional contribution. There are quite a few conditions, but the key requirements are that:

- Your income is less than $37,697;

- 10% or more of your income is from employment;

- You are less than 71; and

- You have not exceeded the non concessional super contribution cap in the year that the contribution is made ($100,000 per annum).

This is a great incentive for two income families where one family member may be working part time.

- Spouse super contribution rebate

The spouse rebate is a $540 income tax rebate (in plain English, a reduction in tax) that is available to you if you contribute $3,000 to super on behalf of your spouse from after tax money.

Again, there are quite a few conditions, but the key requirements are that:

- Your spouse’s income is $37,000 or less;

- Your spouse is less than their retirement age or between their retirement age and 65 and not retired;

- And your spouse has not exceeded the non concessional super contribution cap in the year that the contribution is made ($100,000 per annum).

A ‘spouse’ can be your legally married partner with whom you live or your defacto partner (including same sex partners). This is a great incentive for a single income family or where one family member may be out of the workforce for a period of time.

These are just a few of the many planning opportunities that are available to you in relation to accumulating wealth in super. If you’d like to get a better understanding of the superannuation system or how you can use these Government incentives to improve your position, reach out as we would be glad to help.

You can contact Bishop Collins Chartered Accountants on (02) 4353 2333, mail@bishopcollins.com.au or use our contact us form at https://www.bishopcollins.com.au/contact-us/